Virtual USDT Price Overview: Latest Movements and Technical Analysis

VIRTUAL_USDT Introduction

VIRTUAL_USDT is the spot trading pair of the Virtuals Protocol (VIRTUAL) against the stablecoin USDT in the cryptocurrency market, with active trading on several mainstream exchanges such as Gate, Binance, and Bybit. The VIRTUAL project is dedicated to building a modular AI blockchain ecosystem, aiming to address the decentralized needs of scenarios such as identity verification and data analysis by introducing various AI intelligent agent applications.

Latest prices and market data

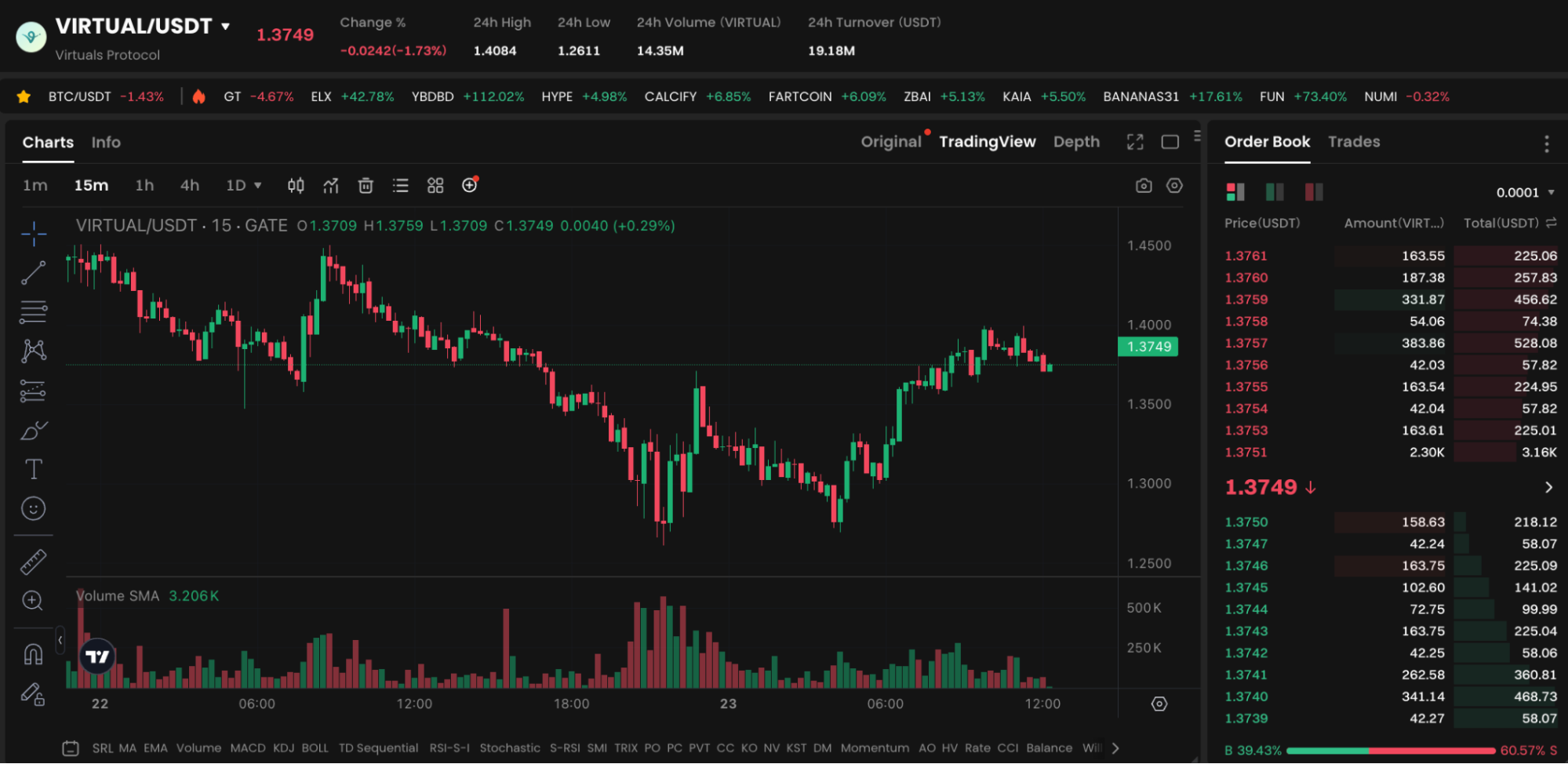

Figure:https://www.gate.com/trade/VIRTUAL_USDT

As of June 23, 2025, the latest quote for VIRTUAL_USDT is 1.40 USDT, fluctuating between 1.28 USDT and 1.41 USDT within the last 24 hours, with a trading volume of 304,534,327 USD and a market capitalization of approximately 914,442,911 USD. Recently, the short-term volatility has been small, showing a slight downward trend overall.

Technical Highlights: Head and Shoulders Top Pattern

The recent 12-hour chart shows that after reaching a high of 2.5850 USDT in May, the price of VIRTUAL has gradually retreated and formed a left and right shoulder structure around 2.20 USDT. The “head” peak of the central is at 2.5850 USDT, with the connecting neckline at 1.6125 USDT. The current price has fallen below this neckline, establishing a typical head and shoulders top reversal pattern. A breach below 1.50 USDT in the short term will intensify bearish pressure, while a return above the neckline may break the weak trend.

Short-term and medium-term trend outlook

- Short-term (1-2 weeks): If it breaks below the psychological support of 1.30 USDT, the bears may continue to exert pressure, with a key focus on the area around 1.00 USDT; if it quickly rebounds and firmly holds the neck line at 1.61 USDT, a stepwise technical rebound is expected.

- Medium term (1–3 months): Before the overall market stabilizes, VIRTUAL will still be under pressure, and it may only strengthen again when Bitcoin and Ethereum regain key resistance levels.

Beginner Trading Tips

- Set stop-loss and take-profit: Given the potential breakdown risk of the head and shoulders pattern, it is recommended to set a stop-loss near 1.30 USDT to protect the principal; if the market reverses, profits can be taken in batches in the range of 1.60–1.70 USDT.

- Position control: Beginners should not heavily invest; sufficient funds should be reserved to cope with fluctuations.

- Pay attention to the market trend: closely track BTC/ETH movements and macro news, such as the Federal Reserve’s interest rate decisions and important compliance developments, and adjust strategies in a timely manner.

- Utilize staggered buying: gradually build positions when the price retraces to the 1.20–1.30 USDT range to reduce the risk of a single purchase.